Forex

If you have landed on this page, it means that you are curious about this extremely popular market. Here you will find all the information you need to better understand What is Forex.

Let’s start by answering four key questions:

- What is forex

- Why Trade Forex

- The advantages of forex with Wealthvoy

- How to open forex positions

The foreign exchange market, also known as the forex (FX) market, is a decentralized international financial market in which investors and speculators exchange one currency for another. Transactions do not take place, as with stocks or commodities on the stock exchange, but directly between the parties, in the so-called over-the-counter (OTC) market.

The forex market is not a market of mere financial speculation, as it has ancient origins and was born on the basis of commercial needs to exchange one currency for another, in order to conclude transactions. Trading, nowadays, takes place on the so-called interbank market, non-stop 24 hours a day, five days a week. The forex market operates thanks to a global interbank network, distributed across four main trading centers that cover all global time zones (London, New York, Sydney and Tokyo).

Currently, the forex market is one of the largest markets in the world, with a daily trading volume of over $5 trillion.

What does Forex Trading mean?

Behind this term, there is a very simple operation, which is based on the need, as already indicated, to change currency. If we have been outside the euro area, we will most likely have had the opportunity to trade Forex, asking the exchange agent or bank to convert euros with the local currency to be able to purchase locally.

Forex trading is nothing more than buying or selling currencies. Like us, banks, central banks, companies, institutional investors and ordinary traders trade on the forex market to meet various needs, including international trade, tourism, investment, market stabilization or simply to try to generate a profit from the spread between the buying and selling price.

WITHDRAWALSWhat is an online broker?

Brokers are nothing but intermediaries that provide traders with the ability to access the interbank market 24 hours a day in order to make transactions in the forex market.

Wealthvoy is one of the world’s leading brokers, duly regulated by 6 global regulators and provides customized services and features based on the goals and needs of each individual client, from retail to professional

Forex contracts

Forex trading operations mainly take place in the form of three different contracts:

Spot

Spot forex contracts are contracts in which parties agree to buy or sell currency at the current market price. This contract is executed “on the spot”.

Forward (forward)

Futures contracts, also known as forward contracts, involve a forex contract in which a certain price is stipulated at which one currency is to be exchanged for another. This form of contract can be open-ended (with no expiration date) or have a cut-off date by which the contract can be executed, but after which it will be cancelled. This type of contract is commonly used in trading strategies to set an order at a specific price that is not currently available.

Future

Forex futures contracts are contracts that agree to buy or sell currencies at a certain price on a specific date. The main difference between forward contracts and futures contracts is that futures contracts are binding on the parties, who are required to fulfill the exchange contract by the expiration date.

Forex Pairs Classification

As we have seen, currencies are traded in pairs. While virtually any world currency can be exchanged for another, there are some currencies that attract a greater volume of trade, mostly based on the size of the economy they are trading in and the global trades they engage in. As a result, currencies are commonly classified into:

Major couples

This is the most commonly traded group of currencies, accounting for over 80% of all trades on the currency market. The high availability and liquidity make trading conditions on these pairs particularly advantageous, with relatively low spreads compared to other less traded pairs.

| Forex Pairs | Names |

| EUR/USD | Euro – US Dollar (Eurodollar) |

| GBP/USD | British Pound – US Dollar (cable) |

| USD/JPY | US Dollar – Japanese Yen (Gopher) |

| USD/CHF | US Dollar – Swiss Franc (swissie) |

| USD/CAD | US Dollar – Canadian Dollar (Loonie) |

| AUD/USD | Australian Dollar – US Dollar (Aussie) |

| NZD/USD | New Zealand Dollar – US Dollar (Kiwi) |

Minor couples

These are currency pairs that are less liquid than the major pairs and are sometimes also known as currency crosses or simply crosses. These are pairs that do not include the US dollar, but include major global currencies, such as the euro, the British pound, or the Japanese yen. Common minor pairs include EUR/CHF, EUR/NZD, GBP/AUD, GBP/AUD, GBP/JPY, CAD/JPY, etc.

Exotic Couples

So-called “exotic” currency pairs are those involving an emerging market currency. These currencies have low liquidity and very low trading volume, when compared to other pairs. Among the most popular exotic pairs are USD/TRY, USD/MXN and USD/ZAR.

| Codes of the main currencies | |

| EUR | Euro |

| USD | US Dollar |

| JPY | JPY |

| GBP | British Pound |

| CHF | Swiss Franc |

| AUD | Australian Dollar |

| CAD | Canadian Dollar |

| NZD | New Zealand Dollar |

| MXN | Mexican Peso |

| NOK | Norwegian Krone |

| DKK | Danish Krone |

| SEK | Swedish crown |

| TRY | Turkish Lira |

| CZAR | South African Rand |

What Affects the Forex Market and Exchange Rates

The movement of exchange rates depends on several factors, including:

- Macroeconomic factors

(e.g. political instability of a country, wars, large-scale operations by central banks, multinationals, etc.)

- Microeconomic factors

- Inflation

- Financial speculation

- Supply/Demand

- Economic events

Why Trade Forex?

Traders operate in the forex market for two main reasons: to buy and sell currency to operate in the goods and services sector or for financial speculation.

Buying and selling goods and services abroad

In a global economy, businesses that operate abroad and buyers who want to buy outside their home market need to convert their currency to complete an international trade. For this reason, forex is of fundamental importance to businesses and individuals who operate internationally. This is the most common form of trading. Whenever a person or business needs to buy something in a foreign currency, a forex trade is required. Therefore, forex is of fundamental importance to international trade. Trading in the forex market occurs continuously, day and night, but forex trading motivated by the buying and selling of goods and services constitutes a relatively small part of overall trading.

Speculation

Most transactions that take place in the currency markets are aimed at generating a profit. Investors who speculate in this field are not interested in owning a foreign currency in order to use it, but aim exclusively to profit from market fluctuations by exploiting the difference between the purchase price and the sale price (or vice versa).

Many traders tend to operate with a short-term time horizon, sometimes with several trades opened and closed within the same trading day. This category of traders is called day traders. The ease with which it is possible to operate on the forex market makes currencies an extremely liquid asset and this is the basis of the relatively higher volatility when compared to that of other markets that enjoy a lower trading volume.

The forex market is open 24 hours a day, 5 days a week, from opening on Monday morning in Sydney to closing on Friday afternoon in New York.

Low commissions

Wealthvoy does not apply any hidden costs, interest or broker commissions, except for the spread, which is the difference between the bid price and the ask price.

High liquidity

Forex is one of the most liquid markets in the world with millions of daily transactions worth over $5 trillion.

Leverage

Leverage is a mechanism that allows you to multiply the value of your position and only deposit a small amount of capital as collateral. This allows you to take significantly larger positions and thus increase the potential profit or loss of your investment. The available leverage varies depending on your country of residence and the classification of the trader.

Long and short positions

When you decide to do fx trading, you can choose to open a (long) position to buy a currency, with the prospect that it will increase in value, or open a short position, that is, to sell, if you believe that it will lose value, in order to buy it back later at a more convenient price. In this way, traders can take advantage of both bullish and bearish markets, provided they correctly predict their movement.

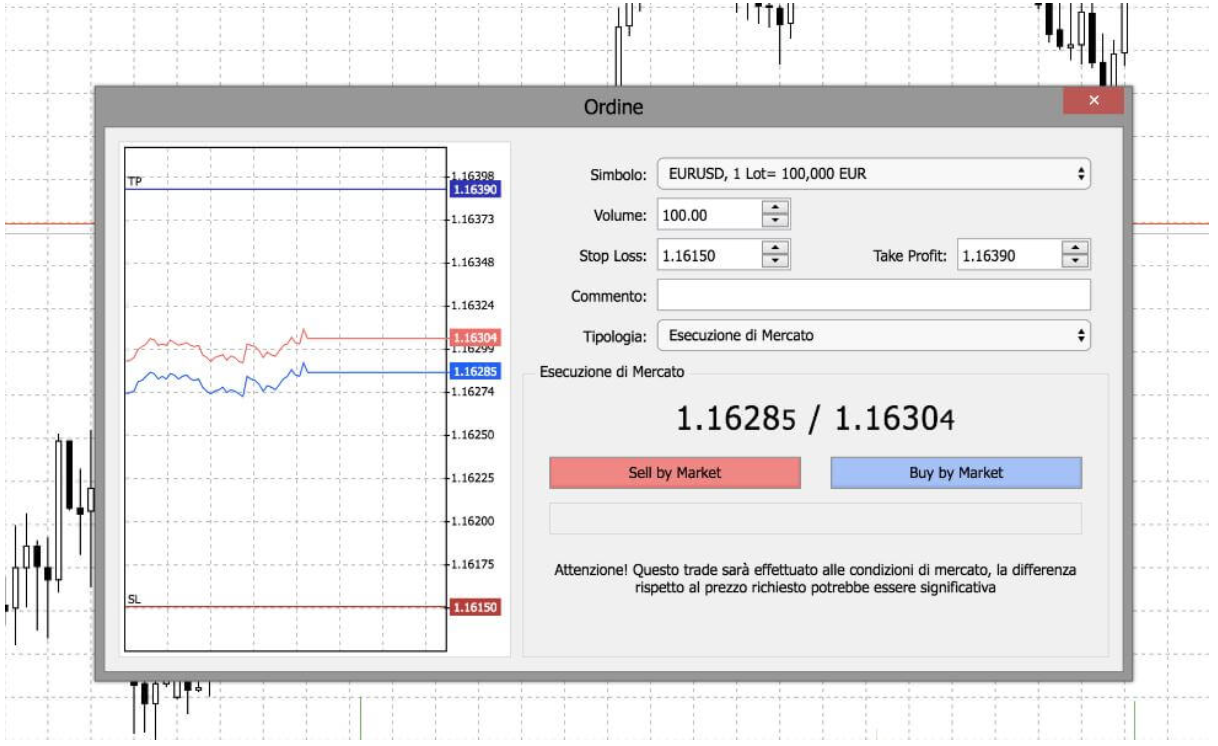

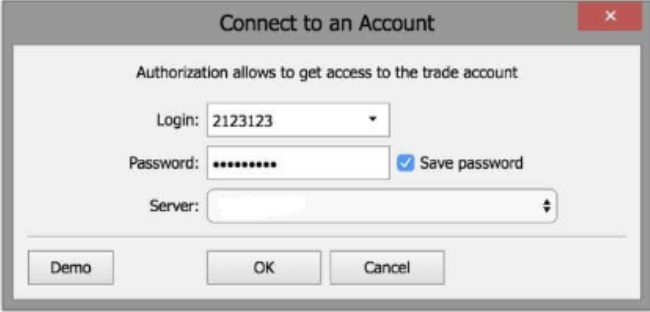

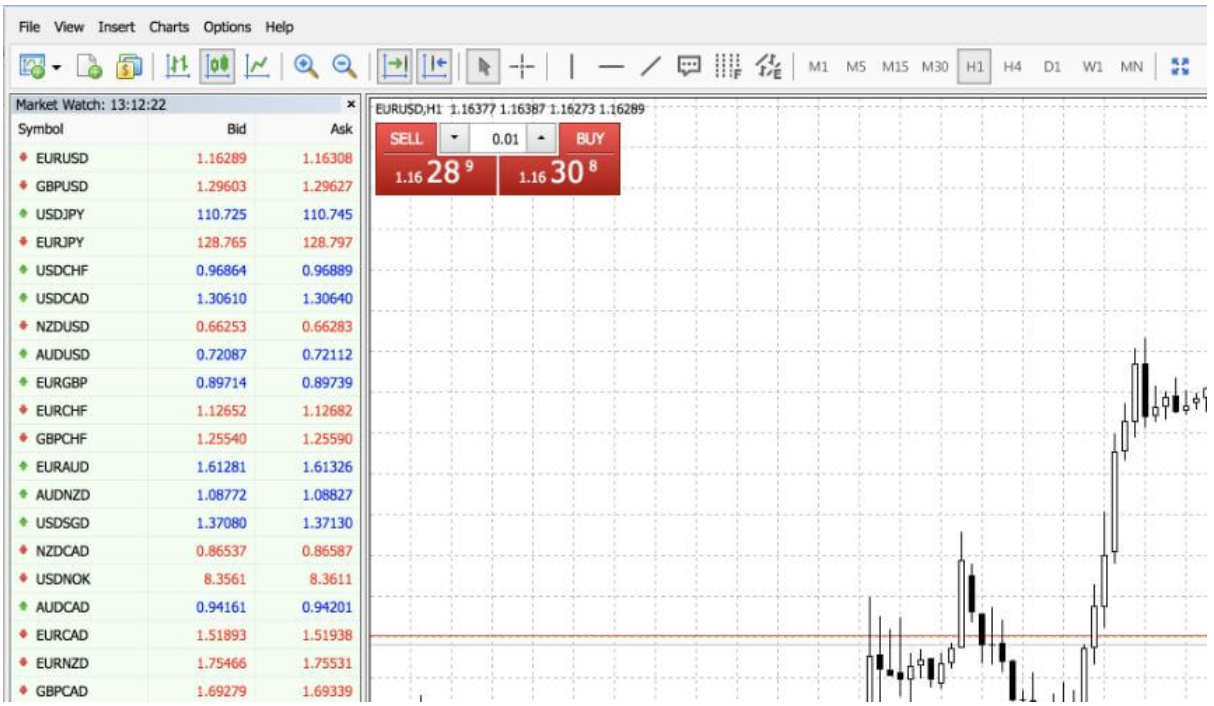

Forex Trading Platforms

Wealthvoy offers a wide range of trading platforms to trade from both mobile and desktop devices via the world’s leading forex trading platform, MetaTrader 4.

- Open an account on Wealthvoy

- Download MetaTrader4 and install it or access the MetaTrader Web Trader directly from your web browser.

- In this demo we will use MetaTrader Web.

That’s all there is to it! Do you want to take advantage of the most liquid market in the world and start trading Forex? Open a real or demo trading account on Wealthvoy now and let your account manager guide you through the world of Forex.